About 51 years ago, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett held his company's first annual shareholder meeting in the cafeteria of a subsidiary, drawing several dozen people. Just over a week ago, Berkshire lured about 40,000 investors to Omaha, Nebraska, for its latest annual meeting.

People flock to this annual gathering to hear the “Oracle of Omaha.” talk about his investment philosophythe US economy, and select Berkshire stocks.

While these annual gatherings consistently project an upbeat tone and align with the long-term investing ethos of Warren Buffett and the late Charlie Munger, Berkshire Hathaway's 2024 meeting was overshadowed by a very large number that issued a subtle warning that Wall Street would be foolish (with a small “f”) to ignore.

Warren Buffett remains a net seller of stocks

Although we won't get a precise picture of Berkshire Hathaway's $360 billion investment portfolio until Wednesday, May 15, when the company files Form 13F with the Securities and Exchange Commission, the company's operating results speak volumes about what Buffett and make its top investments. assistants, Todd Combs and Ted Weschler, did this.

During the quarter ending in March, the Oracle of Omaha and his team sold nearly $20 billion worth of stock, while buying less than $2.7 billion. This marked the sixth consecutive quarter that Berkshire Hathaway was a net seller of shares. All told, net sales activity has reached $56 billion since October 1, 2022.

A significant percentage of the nearly $20 billion in equity sales in the first quarter related to the sale of approximately 115 million shares of technology stocks Apple (NASDAQ: AAPL)which is still by far the largest holding in Berkshire's investment portfolio.

During his annual Q&A with investors, Warren Buffett suggested that tax reasons were behind the sharp cut in his Apple share. The Oracle noted that while the top marginal corporate tax rate is currently 21%, changes in fiscal policy are likely to increase this figure in the future. Capturing profits at a lower tax rate is something he thinks Berkshire shareholders will appreciate.

Berkshire Hathaway's cash pile is growing, and that's historically concerning

The bigger story, however, is that Berkshire's cash pile, which includes cash, cash equivalents and Treasuries, rose from $167.6 billion at the end of March to $189 billion at the end of 2023. Warren Buffett opined at the annual shareholder meeting that his company's war chest could reach the psychological mark of $200 billion when the current quarter ends.

Having a lot of capital is generally viewed as a positive by Wall Street and investors. But that is not the case for a great investor like Warren Buffett, who has been running circles around Wall Street's benchmark for almost sixty years. S&P500 (SNPINDEX: ^GSPC) index by putting his company's money to work through investments and acquisitions – Berkshire owns about five dozen companies, including railroad BNSF and insurer GEICO.

During Berkshire's annual meetings, as well as in Buffett's annual letter to shareholders, Oracle almost always strikes a positive tone about the US economy and long-term investments. However, Berkshire's continued cash buildup makes it clear that Buffett and his team see little value.

Berkshire Hathaway's greatest investing minds are focused on buying shares in great companies at a “fair” price. Right now that is the S&P 500 extraordinary pricey.

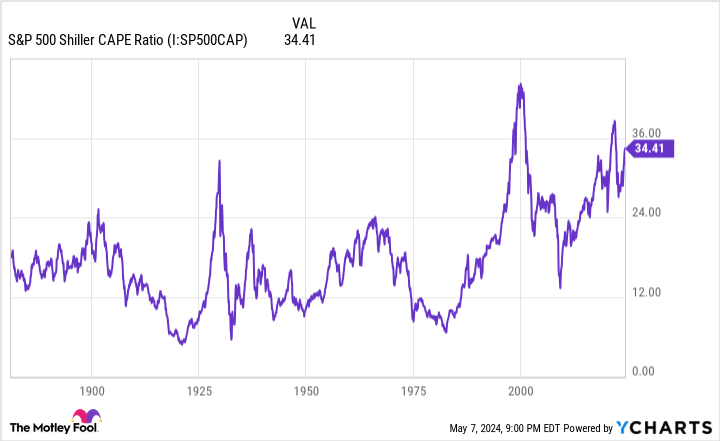

As the closing bell rang on May 7, the S&P 500's Shiller price-to-earnings (P/E) ratio (also known as the cyclically adjusted price-to-earnings ratio, or CAPE ratio) clocked in at 33.95. The Shiller P/E ratio is based on average inflation-adjusted earnings over the past ten years, meaning the impact of one-off events like the COVID-19 pandemic smooths out over time.

Not only is its current value nearly double the average multiple of this valuation tool when backtested to 1871, but it also marks the third-highest value during a bull market. In clearer terms, stocks are Real pricey at the moment.

The five previous instances where the Shiller price-to-earnings ratio exceeded 30 during a bull market ultimately resulted in the S&P 500 and/or Dow Jones Industrial Average lose between 20% and 89% of their value. We may not know in advance when this downturn will take shape, but a Shiller price-to-earnings ratio above 30 has historically been a clear warning sign that Wall Street is in for a correction.

Perhaps not coincidentally, we also witnessed Berkshire's money supply grow substantially just before the burst of the dotcom bubble, the 2007 housing bust, and the 2022 bear market.

This isn't Warren Buffett's first rodeo – trust the process

In addition to Warren Buffett's subtle warning with his company's growing money supply that the stock market may be trading at an irrational valuation, we have witnessed the first notable decline in the US M2 money supply since the Great Depression. All signs seem to point to a downward trend in the US economy and/or stock market in the not-too-distant future.

While this may not be what you want to hear as an investor, keep in mind that this isn't Warren Buffett's first rodeo. He successfully steered Berkshire Hathaway through a number of recessions, geopolitical concerns and stock market corrections/bear markets during his nearly six decades at the helm. His business has gone from strength to strength after each of these events.

It can be said that Warren Buffett's greatest strength is putting his company's capital to work during the day periods of historical fear and uncertainty.

For example, Buffett's company was instrumental in helping bank of America to rebuild confidence in its shares. Berkshire acquired $5 billion in preferred stock from BofA to shore up its capital reserves during the 2011 debt ceiling crisis. This position, which also came with warrants to purchase up to 700 million shares of Bank of America common stock for $7.14, Berkshire yielded a nice profit.

Buffett, Combs and Weschler also fully understand the difference between short-term instability and long-term expansion. Only three of the twelve US recessions since the end of World War II reached the twelve-month mark, and none of the remaining three lasted longer than eighteen months. By comparison, most periods of economic expansion last several years, with two periods of growth exceeding ten years.

This same difference between optimism and skepticism can be seen in the stock market.

Last June, researchers at Bespoke Investment Group published a data set that exhaustively calculated the length of every bear and bull market in the S&P 500 since the start of the Great Depression in September 1929. While the average bear market in the S&P 500 has lasted just 286 calendar days (about 9.5 months), the typical S&P 500 bull market has endured 1,011 calendar days (about two years and nine months) over a 94-year period.

Even though Buffett's short-term actions sometimes don't align with his long-term vision, he still firmly believes in America and the US stock market – and you should too.

Should You Invest $1,000 in Berkshire Hathaway Right Now?

Consider the following before buying Berkshire Hathaway stock:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool holds positions in and recommends Apple, Bank of America and Berkshire Hathaway. The Motley Fool has one disclosure policy.

Warren Buffett's $189 billion subtle warning to Wall Street should not be ignored was originally published by The Motley Fool