Shares of Palantir Technologies (NYSE:PLTR) fell 8%, despite the company reporting solid first-quarter results and raising its full-year guidance.

Let's take a look at the company's quarterly results, why the stock is falling, and whether this is a buying opportunity for long-term investors.

Accelerating growth again

Palantir reported strong first-quarter results, with revenue growing 21% to $634 million. That was the third quarter in a row in which sales growth accelerated. Revenue growth bottomed out at 13% in the second quarter of 2023 before accelerating to 17% in the third quarter and 20% in the fourth quarter last year.

Commercial revenues rose 27% to $299 million, led by a 40% increase in U.S. commercial revenues to $150 million. Excluding strategic commercial contracts, commercial revenue increased 36%, while US commercial revenue increased 68%.

The company added a net 41 new customers to its U.S. commercial operations, while also saying it is seeing solid expansion among existing customers. Palantir has credited its Artificial Intelligence Platform (AIP) with strong commercial growth in the US, as well as its continued focus on 'Bootcamps', which it uses to introduce AIP to new customers. An example was used of a large utility company that signed a seven-figure deal just days after completing a Bootcamp.

International commercial revenues, meanwhile, rose 16% to $149 million, but then fell 3%. The company said it continues to experience headwinds in Europe and saw a sales increase in the fourth quarter that it did not see in the first quarter.

AIP offers the largest potential future growth driver for Palantir, so its rapid adoption among US commercial customers is a big positive. The company has shown that it not only has a strong product, but that its go-to-market strategy with the Bootcamps also works. However, the relatively modest growth from Europe, which represents about 16% of sales, is somewhat discouraging. Palantir discussed the weak macroeconomic situation in Europe, but that's true AI platform should seemingly be able to help reduce costs and these types of activities should not be so affected by macro weakness.

On the government side of the business, revenue grew 16% to $335 million. US government revenues rose 12% from a year ago, then rose 8% to $257 million. Palantir noted that it is the sole contractor for the Army's TITAN (Tactical Intelligence Targeting Node) program and that it expects more growth in its U.S. government business over the course of the year. International government revenues rose 33% year over year, but then fell 9% to $79 million.

Palantir's US government business is improving, but overall growth is still relatively modest. This can be a bumpy thing; However, given the current geopolitical tensions, it's a bit disappointing that the company isn't growing faster.

Palantir raised its full-year revenue guidance to a range of $2.677 billion to $2.689 billion, above its previous revenue forecast of $2.652 billion to $2.668 billion. The company also revised its adjusted operating income forecast to a range of $868 million to $880 million. from $834 million to $850 million.

For the second quarter, sales were expected to be between $649 million and $653 million and operating income to be between $209 million and $213 million.

Why the stock fell

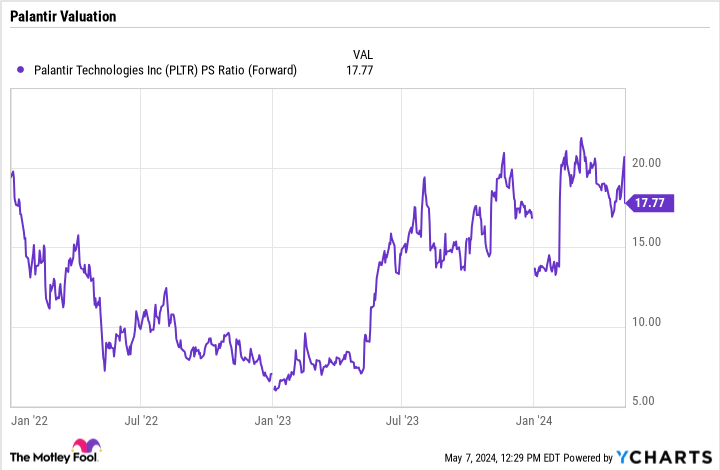

One of the biggest reasons why Palantir shares have fallen despite its solid results is because of its stock valuation. The stock currently trades at forward sales of almost 18x, which is a high multiple for a company that is only growing revenue around 20%, and it was well over 20x above earnings before the stock was sold. To justify this valuation, the company needed to see signs of even faster growth.

Although Palantir has raised its full-year revenue guidance, the top end of the full-year forecast still represents only 21% growth compared to 2023, when it posted revenue of $2.225 billion and analysts generally look for the company to raise its expectations even higher would increase. The company beat the high end of its first-quarter revenue guidance by about $18 million, but only raised the high end of its full-year guidance by about $21 million. A large part of the expected increase stems from the increase in turnover in the first quarter, without much expected follow-up.

Meanwhile, the successive declines in European commercial and international sales growth are also somewhat worrying in light of the stock's valuation. And while U.S. government operations are improving, it is still the slowest growing segment.

Is it time to buy the shares?

Palantir shares have had a huge run over the past year, and much of that was due to expectations of much higher future revenue growth driven by AIP. While AIP has a lot of potential, it hasn't added enough to overall revenue growth at this point to justify Palantir's valuation.

Even with the recent sell-off, Palantir's valuation hasn't fallen enough to warrant trading at 18x forward sales. I would need to see a lower share price or signs that growth will return to above 30% before I can buy the stock.

Should You Invest $1,000 in Palantir Technologies Now?

Before you buy shares in Palantir Technologies, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Palantir Technologies. The Motley Fool has one disclosure policy.

Palantir raised its guidance, but investors are selling. Is it time to buy the shares? was originally published by The Motley Fool