As earnings season comes into full bloom, some companies outside of big tech are attracting investor attention.

Coffee chain Starbucks (NASDAQ:SBUX) is a company that is closely watched because its trends can provide unique insights into the health of the economy and consumer purchasing behavior.

Last week, Starbucks announced results for the second quarter of fiscal 2024, ending March 31. Overall, the report didn't leave much to be desired and shares are down 14%.

Let's take a look at Starbucks' earnings report and analyze why I see another coffee chain stock as the better buy.

Challenges across the board

Analyzing retail companies can be difficult. For starters, it can be misleading when a retail company reports sales growth, because investors are often not told how much of this growth comes simply from price increases.

Additionally, it can be difficult to assess a company's organic growth trends as retail companies are constantly opening and closing locations. For this reason, same-store sales are one of the most important metrics for retail businesses.

Same-store sales can be seen as a more useful metric than sales growth because it measures the activity of stores that have been open for at least a year. This provides investors with important insight into the company's traffic and how these trends could lead to further expansion or closure of the outlet in question.

For the period ending March 31, same-store sales declined 4% year over year. Notably, comparable sales fell both domestically and in the US – including major markets such as China.

In addition to a slowdown in same-store sales, management mentioned another challenge during the earnings call – and this one I found quite concerning. Starbucks CEO Laxman Narasimhan admitted that the coffee chain is struggling to drive demand apart from the daily influx of morning commuters.

Where does the loyalty go?

Inflation has been unusually high in recent years. As a result, the Federal Reserve has implemented a number of interest rate increases. The combination of higher prices and rising borrowing costs has undoubtedly weighed on consumers' pricing power.

One area where Starbucks may be losing some momentum is value. I think Starbucks is falling behind consumers because of its prices. Although the prices of goods and services have risen across the board in recent years, Starbucks is seen as a luxury brand – and its food and drinks are expensive compared to alternatives.

Called a smaller chain Dutch Brothers (NYSE: BROS) has shown impressive growth in recent years, and I suspect some coffee lovers will choose this instead of Starbucks.

For the period ending March 31, Dutch Bros reported that same-store sales increased 10% year over year. Additionally, revenue for the quarter increased 40% year-over-year. By comparison, Starbucks' sales growth during the quarter was flat.

Given the robust operating results, Dutch Bros has increased its revenue and profit forecast for the full year 2024. Not surprising, this is very different from Starbuckswhich lowered its expectations after poor earnings figures.

Are Dutch Bros shares a bargain now?

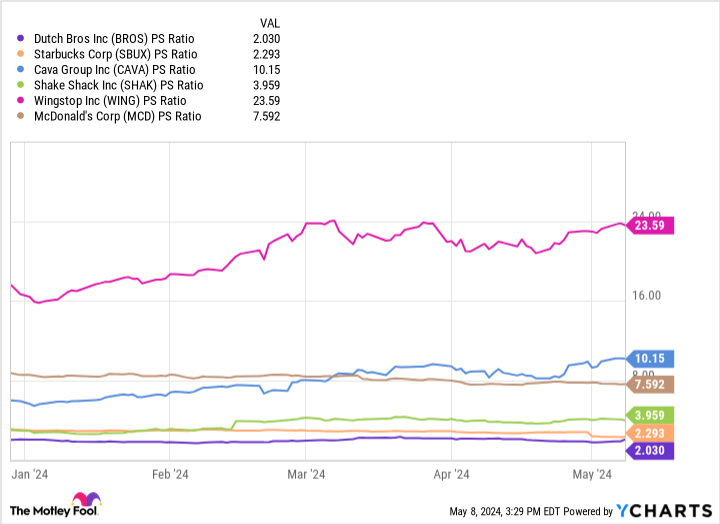

The graph compares Dutch Bros to a cohort of restaurant-adjacent businesses. With a price-to-sales (P/S) multiple of 2, Dutch Bros is the least expensive stock in the peer set based on this measure.

While this may give the impression that Dutch Bros is dirt cheap, I would caution investors against such thinking. Although Starbucks is currently facing some headwinds, it is still a much larger and financially robust company. And yet, looking at the P/S multiples above, Dutch Bros is actually on par with Starbucks.

However, given the company's organic growth and positive prospects, I think the premium is justified for Dutch Bros. In general, for any retail business, expansion will be the biggest challenge. For now, Dutch Bros is largely a West Coast operation. Considering Starbucks has locations in 80 countries, Dutch Bros still has a long way to go before it reaches commensurate scale.

I think investors looking for growth opportunities outside the obvious sectors like technology, healthcare or energy might consider Dutch Bros. In consumer durables, the company has established itself as more than a niche player. While the stock may be a bit pricey right now, I think long-term investors will still reap significant upside.

Should you invest $1,000 in Dutch Bros now?

Consider the following before purchasing shares in Dutch Bros:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Dutch Bros wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Starbucks and Wingstop. The Motley Fool recommends Cava Group. The Motley Fool has one disclosure policy.

Forget Starbucks: Buy this other sizzling coffee chain stock instead was originally published by The Motley Fool